From the Desk of

Nancy E. Peterman ¦ Partner

The Estate Planning Journey

For decades I’ve encouraged donors to complete their estate plans to ensure that the charities they support in their lifetime are included in their plans. The process frequently dragged on, even as they were promising that this was a priority for them and that their beloved institution (for which I worked) would be included. Sometimes, the plan was never finished. Years later, I admit this was hypocritical of me to be so forthright in my passionate plea for their completed estate plans

My spouse and I had wills, that is, quarter-century-old wills that were written for the needs of minor children, who are now emancipated adults, several with children of their own. No charities were beneficiaries, despite our annual and capital support of several causes which we claim are important. The list of excuses that supported our inaction: 1) Our age—we are much too young. 2) Our total assets—not enough. 3) Not our problem—we can leave it to our four children to figure this out. 4) It’s too time-consuming—we’re too busy. 5) Estate Planning would mean that we must deal with attorneys, wealth planners, etc. and we don’t know anyone in our area. 6) We may not agree.

Nevertheless, having relocated to a different state, and the realization that: 1) We are old and mortal. 2) Even a modest estate could have complications for four siblings—one of whom lives abroad; the others are scattered on both coasts. 3) We support several causes which could and should benefit from our estate. 4) We discussed our values and realized how closely we were aligned. This would not be complicated.

Thirteen months later, we aren’t finished but have made great progress and are editing the second drafts of our wills, trusts, etc. I anticipate there will be additional changes after these are finalized. The first drafts included select religious and educational institutions which were the primary recipients of our current giving. However, our lives and activities have changed along with our address. I’m now regularly playing in two orchestras and for a chamber music society. My husband is teaching at a medical school, not one that was in our original plan. An annual review of our plan will ensure that we will include these organizations and others we encounter along the way.

Certainly, the catalyst which got us started was the introduction of Thompson and Associates, a values-based Estate Planning firm, whose services were made available to us by an organization that we support financially. We underwent their six-month individualized planning process with the expert guidance of Tom Cullinan, JD, FCEP, in private, monthly conference calls to help us formulate our estate plans. Ultimately, they provided a summary of our desires and estate planning recommendations. We were able to provide that information to a local attorney to develop the documents needed to complete the plan. I highly recommend that any organization which would like to encourage estate giving among its major donors to explore the services of Thompson and Associates www.ceplan.com.

The competition for planned gifts has increased significantly. According to Giving USA the number of 501 (c) 3 organizations grew to 1,480,565 by the end of 2022. Although that was a 3.5% increase from the previous year, it is a 37% increase over a ten-year period. However, the most compelling case for organizations encouraging planned giving in 2023 may be this insight about current giving, which declined slightly in 2022. According to Una Osili, Ph.D., Associate Dean for Research and International Programs at the Lilly Family School of Philanthropy, “The economic picture that emerges suggests that many households were stable—we did not see job losses or an increase in unemployment the way we did in the Great Recession. However, households tend to give when they are financially and economically secure – and the inflationary pressures meant that fewer households had extra to give. In addition, donors may not have been as compelled to respond to immediate needs as they had been during the early days of the COVID-19 pandemic or during the Great Recession.”

Additional stats on Bequests from Giving USA 2022

- Estimated bequest giving from estates $10 million and above (filing estates) amounted to $24.27 billion.

- Estimated bequest giving from estates between $1 and $10 million amounted to $9.47 billion.

- Estimated bequest giving from estates with assets below $1 million amounted to $11.86 billion.

- Giving by bequest declined 5.6% in current dollars between 2020 and 2021.

- Giving by bequest grew 2.3% between 2021 and 2022. The cumulative change in current-dollar bequest giving between 2020 and 2022 is -3.4%.

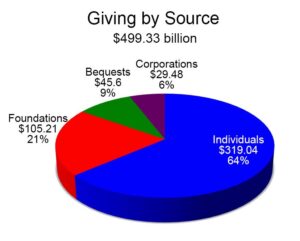

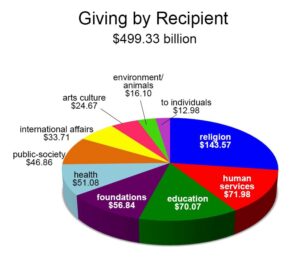

Giving in 2022: $499.33 Billion

Total giving in the United States decreased in 2022 following two years of record generosity during the COVID-19 pandemic, down 3.4 percent in current dollars and 10.5 percent after adjusting for inflation, a report from Giving USA finds.

Produced by the Giving USA Foundation and the Indiana University Lilly Family School of Philanthropy, the report, Giving USA 2023: The Annual Report on Philanthropy for the Year 2022, estimates that charitable giving totaled $499.33 billion in 2022, down from the revised total in 2021 of $516.65 billion. The report noted that declines are usually seen during years with difficult or unusual economic conditions. Giving in 2022 was influenced by stock market volatility and economic uncertainty. There was growth in three of the four sources of giving (foundations, bequests, and corporations) in 2022 in current dollars, but all four sources declined after adjusting for inflation. Giving by foundations and corporations, however, posted positive two-year growth, even when adjusting for inflation. In inflation-adjusted terms, seven of the nine subsectors experienced a decline.

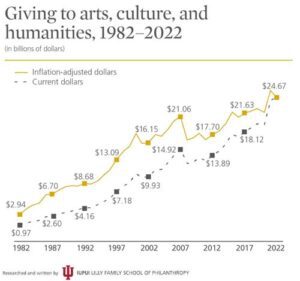

Giving to the Arts

- Giving to the arts, culture, and humanities subsector amounted to 5% of total giving in 2022 and was estimated at $24.67 billion.

- Giving to this subsector increased 2.9% from 2021. Adjusted for inflation, giving to these organizations declined by 4.7%.

- The total amount contributed reached its second-highest value in 2022 when adjusted for inflation.

- According to the Benchmarks 2023 report by M+R, online revenue for cultural organizations decreased by 13% in 2022 after growing 21% in 2021.

Client Partner News Our Client Partner, South Arts, received contributions totaling $1.3 million toward Southern Cultural Treasures: a $6,000,000, multi-year initiative supporting Black, Indigenous, and People of Color (BIPOC) led- and -serving arts and cultural organizations throughout the Southeast. These contributions have successfully matched challenge grants to fully fund this initiative. In total, $6.7 million was raised.

Our Client Partner, South Arts, received contributions totaling $1.3 million toward Southern Cultural Treasures: a $6,000,000, multi-year initiative supporting Black, Indigenous, and People of Color (BIPOC) led- and -serving arts and cultural organizations throughout the Southeast. These contributions have successfully matched challenge grants to fully fund this initiative. In total, $6.7 million was raised.

The organization awarded grants to 17 organizations that represent BIPOC arts and community-driven stewardship throughout their nine-state region. Congratulations to our alumni client, the B.B. King Museum and Delta Interpretive Center (Indianola, MS), who was a recipiente.

We Know Museums

For more than 35 years, Alexander Haas has been a fixture in the nonprofit community. We are honored to have worked with leading museums and cultural organizations across the country that help communities be a better place to live. Just ask our clients.

Face It: Museums are Different

Our services aren’t cookie cutter. We don’t operate with a boilerplate, merely changing names and locations. We craft each and every service we provide to match your museum’s unique needs, wants and abilities. We work hard and expect you to do the same. Together we can help you transform your museum, your fundraising, and the community you serve.

Whether your need is in Capital Campaign, Annual Fund Campaign, Major Gifts, Leadership Annual Giving, Planned Giving or all of the above, we take a fresh approach to nonprofit fundraising.