From the Desk of

Nancy E. Peterman ¦ Partner

Donor Advised Funds: $230 Billion & Growing

Thought of as a recent phenomenon, Donor Advised Funds, or DAFs, as they are commonly known, came about in the 1930s, which makes them close to a century in age; however, they were not widely accepted until the Pension Protection Act of 2006. Their popularity arose in the 1990s, and many charities have well-defined strategies to cultivate donors who give through DAFs. The number of DAF-sponsoring organizations has grown beyond investment companies to include community foundations, large charitable organizations, and some universities. According to the National Philanthropic Trust, as of 2023, there were about 2 million donor-advised funds. Giving from DAFs was more than $52 billion, approximately ten percent of overall philanthropic giving.

Donors tend to like DAFs as they afford them the opportunity for a tax break in the year that they give but do not require that they distribute funds to various organizations in that same year, effectively functioning as a private foundation without the excessive overhead costs and additional requirements for payout. This is especially acceptable for donors, whose salary may fluctuate significantly from year-to-year, or for those who may choose to give when market returns are favorable, thus enabling them to smooth out their giving to many organizations by use of a DAF. Donors may shield their personal identity if they choose by asking the DAF-sponsoring organization to withhold their names when making payouts. One notable limitation on contributing to a DAF is that a Qualified Charity Distribution from an IRA (as part of the Required Minimum Distribution) may not go to a Donor Advised Fund.

Charities who sponsor DAFs also like them as donors are likely to support the organization with at least some of the DAF deposited with them. It also increases the fund balance of the charity which can boost investment returns. Investment companies have grown their DAF programs significantly without regulation. By sponsoring DAFs, the investment company can truly serve as a financial advisor to the donor for investment management, tax strategies, and philanthropic giving. Both charities who sponsor DAFs, and investment companies benefit from fees charged for managing the individual DAFs.

The Internal Revenue Service proposed new DAF regulations for comments as 2023 ended. First and foremost, the proposed regulations would more carefully define what a DAF is and what it isn’t. Those serving in the advisory role, including donors and the financial advisers, could not benefit in any way from the donation. It would also tighten the restriction on lobbying support. Fee structure would also come under scrutiny especially for financial advisors. And the IRS is not the only one examining DAFs. Congress proposed a bill in 2021 sponsored by Senators Angus King and Chuck Grassley; however, it did not gain sufficient support. Although that bill is dead, others are still discussing the possibility of proposing future DAF legislation.

Interestingly and not surprisingly, according to The Chronicle of Philanthropy, contributions to DAFs grew 133% from 2018 to 2022. According to Chuck Collins at the Institute for Policy Studies, “Donors got tax breaks in 2022 for $85.5 billion in DAF donations. Now, the funds may sit indefinitely.”

Quick Look at the Results for 2023 |

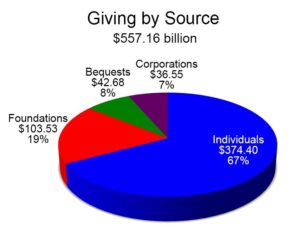

Giving by individuals totaled an estimated $374.40 billion, growing 1.6% in 2023 but declining 2.4%, adjusted for inflation, between 2022 and 2023. Inflation-adjusted giving by individuals declined by 12.6% between 2021 and 2022. The cumulative change in inflation-adjusted giving by individuals between 2021 and 2023 is -14.7%.

Giving by individuals totaled an estimated $374.40 billion, growing 1.6% in 2023 but declining 2.4%, adjusted for inflation, between 2022 and 2023. Inflation-adjusted giving by individuals declined by 12.6% between 2021 and 2022. The cumulative change in inflation-adjusted giving by individuals between 2021 and 2023 is -14.7%.

- Giving by foundations grew 1.7% to an estimated $103.53 billion in 2023 but suffered a decline of 2.3%, adjusted for inflation. Adjusted for inflation, grantmaking by independent, community and operating foundations grew 6.0% between 2021 and 2022. The cumulative change in inflation-adjusted giving by foundations between 2021 and 2023 is 3.6%.

- Giving by bequest totaled an estimated $42.68 billion in 2023, growing by 4.8% over 2022, however remaining relatively flat at 0.6% growth when adjusted for inflation. Giving by bequests declined by 8.6% in inflation-adjusted dollars between 2021 and 2022. The cumulative change in giving by bequest between 2021 and 2023 is -8.0% in inflation-adjusted dollars.

- Giving by corporations is estimated to have increased by 3.0% in 2023, totaling $36.55 billion, which is a decline of 1.1%, adjusted for inflation. Corporate giving includes cash and in-kind contributions made through corporate giving programs, as well as grants and gifts made by corporate foundations. Inflation-adjusted giving by corporations grew 3.3% between 2021 and 2022. The cumulative change in inflation-adjusted giving by corporations between 2021 and 2023 is 2.1%.

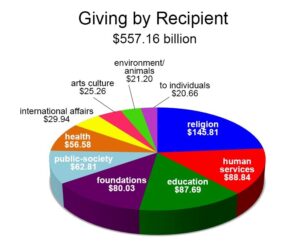

- Religious organizations received the largest share of charitable dollars in 2023, at 24% of total giving. In current dollars, giving to religion increased by 3.1% between 2022 and 2023. Adjusted for inflation giving declined by 1.0% between 2022 and 2023.

- Human services organizations comprised the second-largest portion of total gifts received, at 14% of the total in 2023. In current dollars, giving to this sector increased by 5.8% between 2022 and 2023. Adjusted for inflation, giving increased by 1.7%.

- The education subsector ranked third in total gifts received, at 14% of charitable dollars in 2023. Between 2022 and 2023, inflation-adjusted giving to education increased by 6.7%, and in current dollars, it increased by 11.1%.

- Gifts to grantmaking foundations comprised the fourth-largest share of charitable dollars in 2023, amounting to 13% of total giving. Between 2022 and 2023, inflation-adjusted giving to foundations grew 10.8%, and in current dollars, it increased 15.4%.

- The public-society benefit subsector ranked fifth in total gifts received at 10% of charitable dollars in 2023. In current dollars giving to this sector increased by 11.6% between 2022 and 2033, and in inflation-adjusted increased by 7.2%.

- Comprising the sixth-largest portion of charitable dollars in 2023, the health subsector received 9% of total giving. Adjusted for inflation, giving to this sector grew by 4.4% between 2022 and 2023 and in current dollars grew by 8.7%.

- The international affairs subsector ranked seventh in total gifts received, amounting to 5% of charitable dollars in 2023. Giving to this sector declined by 1.6% in inflation-adjusted dollars and grew by 2.5% in current dollars.

- Arts, culture, and humanities organizations received the eighth-largest portion of charitable dollars in 2023, at 4% of total giving. In current dollars, giving to this sector increased 11.0% between 2022 and 2023 and adjusted for inflation, increased by 6.6%.

- Comprising the ninth-largest share of charitable dollars in 2023, the environment/animals subsector received 3% of total gifts. Adjusted for inflation, giving to this sector grew by 3.9% between 2022 and 2023 and in current dollars, increased by 8.2%.

Giving to Education

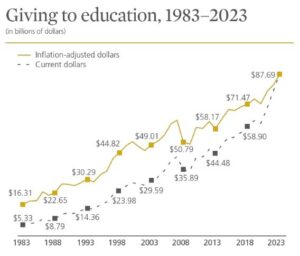

- Giving to the education sector amounted to 14% of total giving in 2023 and grew 11.1% in current dollars from 2022 to $87.69 billion in 2023. Adjusted for inflation, giving increased 6.7%.

- Giving to education increased 5.2% in inflation-adjusted dollars between 2021 and 2022. The cumulative change in giving to education between 2021 and 2023 is 12.2% in inflation-adjusted dollars. In current dollars giving increased 13.6% between 2021 and 2022. The cumulative change in giving to education between 2021 and 2023 is 26.2% in current dollars.

- According to the Council for Advancement and Support of Education, contributions to higher education institutions reached $58 billion in the academic fiscal year 2022-2023, declining 2.5% from the academic fiscal year 2021–2022.

DAF Study Findings

The 2024 National Study on Donor Advised Funds analyzed 57,539 individual accounts. This contrasts with most reports on DAF activity, which typically rely on aggregate 990 data from DAF-sponsoring organizations. The report was the result of voluntary participation by 111 DAF programs at community foundations and national and religiously affiliated sponsoring organizations across the country from 2014 to 2022.

Key Findings

- Nearly half of all DAFs (49%) had total assets at the end of 2021 of less than $50,000. Only 7% of DAFs had balances of $1 million or more—and only 1% had a balance over $10 million.

- DAFs are a relatively young philanthropic vehicle, with increased use in recent years. The vast majority of DAFs in this study (81%) were opened after 2010, and over one in four DAFs in the dataset were opened after 2020.

- About 9% of DAFs were Endowed, meaning they have spending policies that restrict their annual grantmaking to ensure long-term use.

- Almost all DAFs (92%) have a succession plan in place that establishes control of the funds after the original donors are no longer living. Approximately 30% of DAFs designate the sponsor or another nonprofit organization to receive remaining funds.

- Most DAF accounts (97%) were advised by individuals or families. Institutional DAFs — those advised by corporations or other organizations — only compose about 3% of all DAFs.

- One in four DAFs had contributions in some years (less. than half of the years observed).

- 38% of contributions fell within the $10,000 to $49,999 range.

- One in four had contributions in most years (more than half of the years).

- 15% of contributions were in the $50,000 to $99,999 range.

- One in nine had contributions every year.

19% of contributions were within the $100,000 to $499,999 range.

Welcome New & Returning* Client Partners

We Know Colleges & Universities

For more than 35 years, Alexander Haas has been a fixture in the nonprofit community. We are honored to have worked with so many large and small college and universities; both public and private institutions, across the country. These schools that help mold today’s young adults into tomorrow’s leaders. Take a look at our list of higher education clients, past and present.

A Fresh Approach to Fundraising

Our services aren’t cookie cutter. We don’t operate with a boilerplate, merely changing names and locations. We craft each and every service we provide to match your organization’s unique needs, wants and abilities. We work hard and expect you to do the same. Together we can help you transform your institution, your fundraising, and the community you serve.

Whether your need is in Capital Campaign, Annual Fund Campaign, Major Gifts, Leadership Annual Giving, Planned Giving or all of the above, we take a fresh approach to nonprofit fundraising.