From the Desk of

Nancy E. Peterman ¦ Partner

Donor Advised Funds: $230 Billion & Growing

Thought of as a recent phenomenon, Donor Advised Funds, or DAFs, as they are commonly known, came about in the 1930s, which makes them close to a century in age; however, they were not widely accepted until the Pension Protection Act of 2006. Their popularity arose in the 1990s, and many charities have well-defined strategies to cultivate donors who give through DAFs. The number of DAF-sponsoring organizations has grown beyond investment companies to include community foundations, large charitable organizations, and some universities. According to the National Philanthropic Trust, as of 2023, there were about 2 million donor-advised funds. Giving from DAFs was more than $52 billion, approximately ten percent of overall philanthropic giving.

Donors tend to like DAFs as they afford them the opportunity for a tax break in the year that they give but do not require that they distribute funds to various organizations in that same year, effectively functioning as a private foundation without the excessive overhead costs and additional requirements for payout. This is especially acceptable for donors, whose salary may fluctuate significantly from year-to-year, or for those who may choose to give when market returns are favorable, thus enabling them to smooth out their giving to many organizations by use of a DAF. Donors may shield their personal identity if they choose by asking the DAF-sponsoring organization to withhold their names when making payouts. One notable limitation on contributing to a DAF is that a Qualified Charity Distribution from an IRA (as part of the Required Minimum Distribution) may not go to a Donor Advised Fund.

Charities who sponsor DAFs also like them as donors are likely to support the organization with at least some of the DAF deposited with them. It also increases the fund balance of the charity which can boost investment returns. Investment companies have grown their DAF programs significantly without regulation. By sponsoring DAFs, the investment company can truly serve as a financial advisor to the donor for investment management, tax strategies, and philanthropic giving. Both charities who sponsor DAFs, and investment companies benefit from fees charged for managing the individual DAFs.

The Internal Revenue Service proposed new DAF regulations for comments as 2023 ended. First and foremost, the proposed regulations would more carefully define what a DAF is and what it isn’t. Those serving in the advisory role, including donors and the financial advisers, could not benefit in any way from the donation. It would also tighten the restriction on lobbying support. Fee structure would also come under scrutiny especially for financial advisors. And the IRS is not the only one examining DAFs. Congress proposed a bill in 2021 sponsored by Senators Angus King and Chuck Grassley; however, it did not gain sufficient support. Although that bill is dead, others are still discussing the possibility of proposing future DAF legislation.

Interestingly and not surprisingly, according to The Chronicle of Philanthropy, contributions to DAFs grew 133% from 2018 to 2022. According to Chuck Collins at the Institute for Policy Studies, “Donors got tax breaks in 2022 for $85.5 billion in DAF donations. Now, the funds may sit indefinitely.”

DAF Study Findings

The 2024 National Study on Donor Advised Funds analyzed 57,539 individual accounts. This contrasts with most reports on DAF activity, which typically rely on aggregate 990 data from DAF-sponsoring organizations. The report was the result of voluntary participation by 111 DAF programs at community foundations and national and religiously affiliated sponsoring organizations across the country from 2014 to 2022.

Key Findings

- Nearly half of all DAFs (49%) had total assets at the end of 2021 of less than $50,000. Only 7% of DAFs had balances of $1 million or more—and only 1% had a balance over $10 million.

- DAFs are a relatively young philanthropic vehicle, with increased use in recent years. The vast majority of DAFs in this study (81%) were opened after 2010, and over one in four DAFs in the dataset were opened after 2020.

- About 9% of DAFs were Endowed, meaning they have spending policies that restrict their annual grantmaking to ensure long-term use.

- Almost all DAFs (92%) have a succession plan in place that establishes control of the funds after the original donors are no longer living. Approximately 30% of DAFs designate the sponsor or another nonprofit organization to receive remaining funds.

- Most DAF accounts (97%) were advised by individuals or families. Institutional DAFs — those advised by corporations or other organizations — only compose about 3% of all DAFs.

- One in four DAFs had contributions in some years (less. than half of the years observed).

- 38% of contributions fell within the $10,000 to $49,999 range.

- One in four had contributions in most years (more than half of the years).

- 15% of contributions were in the $50,000 to $99,999 range.

- One in nine had contributions every year.

- 19% of contributions were within the $100,000 to $499,999 range.

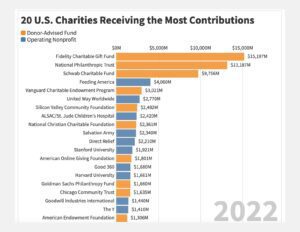

Ten of America’s 20 Top Public Charities Are Donor-Advised Funds

The three highest-earning DAF sponsors each take in more than double the donations of the highest-earning operating charity.

Here is data from 2022.

Vanguard’s Why Giving Matters Survey Released

Vanguard Charitable recently published a new edition of its ongoing Why Giving Matters research series. The report draws on more than a decade’s worth of insight into giving from over 32,000 Vanguard Charitable donor-advised fund accounts and fresh donor survey responses on giving sentiments and behavior.

Top Facts from the Survey

Emergency giving hasn’t diminished planned giving.

The study suggests donors’ unanticipated giving to address events like natural disasters and humanitarian crises also causes donors expected giving to increase, resulting in a boost to their total giving.

Unexpected grants are often repeated.

According to the survey, 46% of nonprofit organizations receiving an unexpected grant from Vanguard Charitable receive a second grant from the same donor in the future.

Donors often respond to multiple emerging needs each year.

Over 72% of donors identified two or more types of events inspiring their unexcet4ed giving, suggesting that donors respond to a variety of prompts for giving.

Unexpected giving needs are identified in a variety of ways.

Some 61% of people who gave unexpectedly did so in direct response to their learning about a humanitarian crisis, while 54% responded to a natural disaster. Some 32% say they gave in response to a direct solicitation from a worthy cause, while 30% responded to a request from friends or family and 19% responded to “other current events.” And 9% report that an economic downturn spurred unexpected giving followed by 7% who increased their giving after a medical diagnosis.

The timing of gifts underscores donors’ responsiveness.

Vanguard donors’ annual granting is typically steady from January through September before increasing at the end of the year to coincide with the charitable sector’s business period.

More DAF gifts are being made digitally.

While grants delivered via paper checks remain an industry standard, they can get delayed. Vanguard’s collaboration with PayPal donors electronically generated more than $735 million to more than 11,000 charities.

Even experienced donors seek due diligence support.

More than half, 52%, of Americans, say they do not know where to find reputable information on how to direct a monetary donation to support those in need.

Does Your Museum Need Help With All Things DAF?

We can help. Our customizable fundraising services can be tailored to your specific wants and needs. Are you approaching a capital campaign? Need to conduct a Campaign Strategy Study? Looking to update your Annual Fund and/or Planned Giving Programs? Does your Board or staff require continuing education on the mechanics of DAFs? We can help you show donors and your leadership how DAF gifts can benefit you on every level of your fundraising program.

Reach out to us and we can show you how to start right here.

We Know Museums

For more than 35 years, Alexander Haas has been a fixture in the nonprofit community. We are honored to have worked with leading museums and cultural organizations across the country that help communities be a better place to live. Just ask our clients.

Face It: Museums are Different

Our services aren’t cookie cutter. We don’t operate with a boilerplate, merely changing names and locations. We craft each and every service we provide to match your museum’s unique needs, wants and abilities. We work hard and expect you to do the same. Together we can help you transform your museum, your fundraising, and the community you serve.

Whether your need is in Capital Campaign, Annual Fund Campaign, Major Gifts, Leadership Annual Giving, Planned Giving or all of the above, we take a fresh approach to nonprofit fundraising.